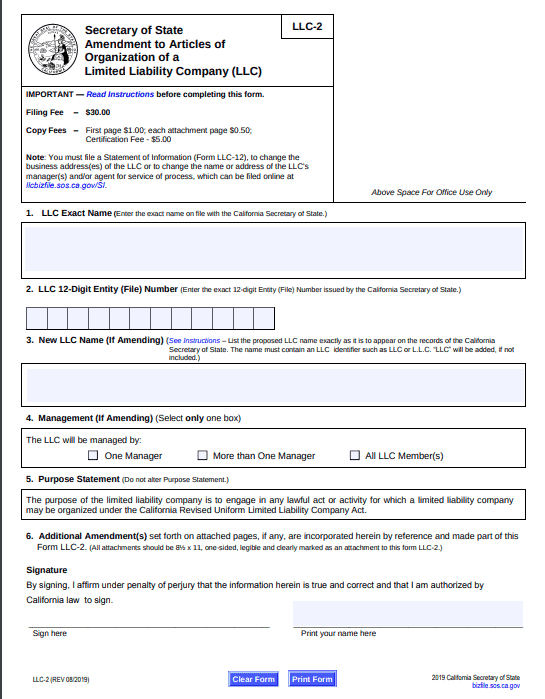

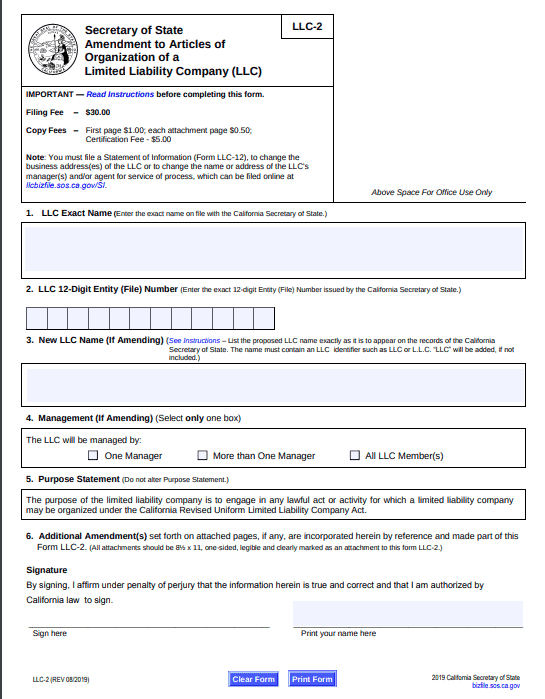

To update your California LLC’s Articles of Organization—the document that legally formed your company in California—you’ll file an Amendment to Articles of Organization with the California Secretary of State. There is a $30 fee for filing an Amendment to Articles of Organization, which you may submit by mail, in person, or online. We’ll show you everything it takes to file California Amendment to Articles of Organization in our free guide.

In this article, we’ll cover:

When you start a California LLC by filing Articles of Organization, the California Secretary of State gathers ownership and contact information for your company. As your LLC grows in the future, you may need to update the information registered on state records about your business. Some, but not all of those changes can be made by filing Form LLC-2 – Amendment to Articles of Organization of a Limited Liability Company.

California LLCs file an Amendment to Articles of Organization when the LLC’s name needs changed, or if there is a need to update the LLC’s management structure from member-managed to manager-managed (or the other way around).

However, changes to your registered agent, the LLC’s principal address, or any information about managers or members must be made by filing a Statement of Information. This can be done for $20 when you submit your LLC’s biennial statement, or between filing periods for no fee.

Yes, you can restate your initial Articles of Organization instead of filing an amendment. File Restated Articles of Organization (form LLC-10) and pay a $30 fee when submitting online or by mail (in-person filings cost $45).

Restating your Articles of Organization allows you to create a single streamlined document created from your original Articles of Organization, any previous amendments, and any new amendments you would like to add at the time of filing.

No, if an error was made on your LLC’s Articles of Organization, you shouldn’t file an Amendment to Articles of Organization. You’ll want to file a Certificate of Correction (Form LP-11) instead. Certificates of Correction allow you to identify errors or other items to be corrected, and retroactively make those fixes effective as of when the Articles of Organization was filed.

Certificates of Correction can be filed by mail or in person for $30—in-person deliveries must also pay an additional $15 service fee. Currently, California does not give LLCs the means to file Certificates of Correction online.

Need help with filing an Amendment to Articles of Organization for your California LLC? Get a free account with Northwest Registered Agent today and get access to our library of business forms.

No matter what you’re changing by amending your Articles of Organization, you’ll need to include the following information on your Amendment to Articles of Organization form:

On section 3 of the form, you have the option of stating the proposed new name of your LLC. The new name must contain an indicator of its LLC status—the word “Limited Liability Company” or initials “LLC”.

To make other changes to your LLC, you can include new amendments for your LLC as attachments to section 6 of the form.

You may file the Amendment to Articles of Organization online, in person or by mail. Filing in person? The state charges a $15 special handling fee for such transactions—making your total $45. This can be paid using a credit card or check made payable to Secretary of State. Mailed submissions can only be paid by check.

Mail filings:

California Secretary of State

Business Programs Division-Business Entities

PO Box 944260

Sacramento, CA 94244-2600

In-person filings:

California Secretary of State

1500 11th Street, Room 390

Sacramento, CA 95814

T: (916) 653-6814

If all you need to amend is your LLC’s name, you can do that directly through the California Secretary of State’s online service, bizfileOnline. You’ll need to register an account to use this online method.

Mailed submissions cost $30 to file. In-person filings will cost $45—this includes a $15 special handling fee. Want expedited service? Add an additional $350 (24 hours), $500 (4 hours), OR $750 (same day). All expedited requests must be filed in person.

To request 4-hour processing, your amendment must be pre-cleared first. Pre-clearance allows you to submit your business filing to the state—in person only—and determine if your document complies with state laws. This will cost between $250 and $500.

It takes approximately 5 business days after receipt by the Secretary of State to process California Amendments to Articles of Organization submitted by mail or in person. However, processing can take longer, depending on current workloads.

Our guide to filing your California LLC’s biennial tax report.

Set the rules for a California LLC with this important document.

All about getting an assumed name for your California business.

sitting at desk with laptop and mailbox behind them." width="300" height="225" />

sitting at desk with laptop and mailbox behind them." width="300" height="225" />

Learn how to change your California registered agent.

Closing up shop? Here’s how to wind your California LLC down.

Want to bring your California LLC back to life? Use our guide.